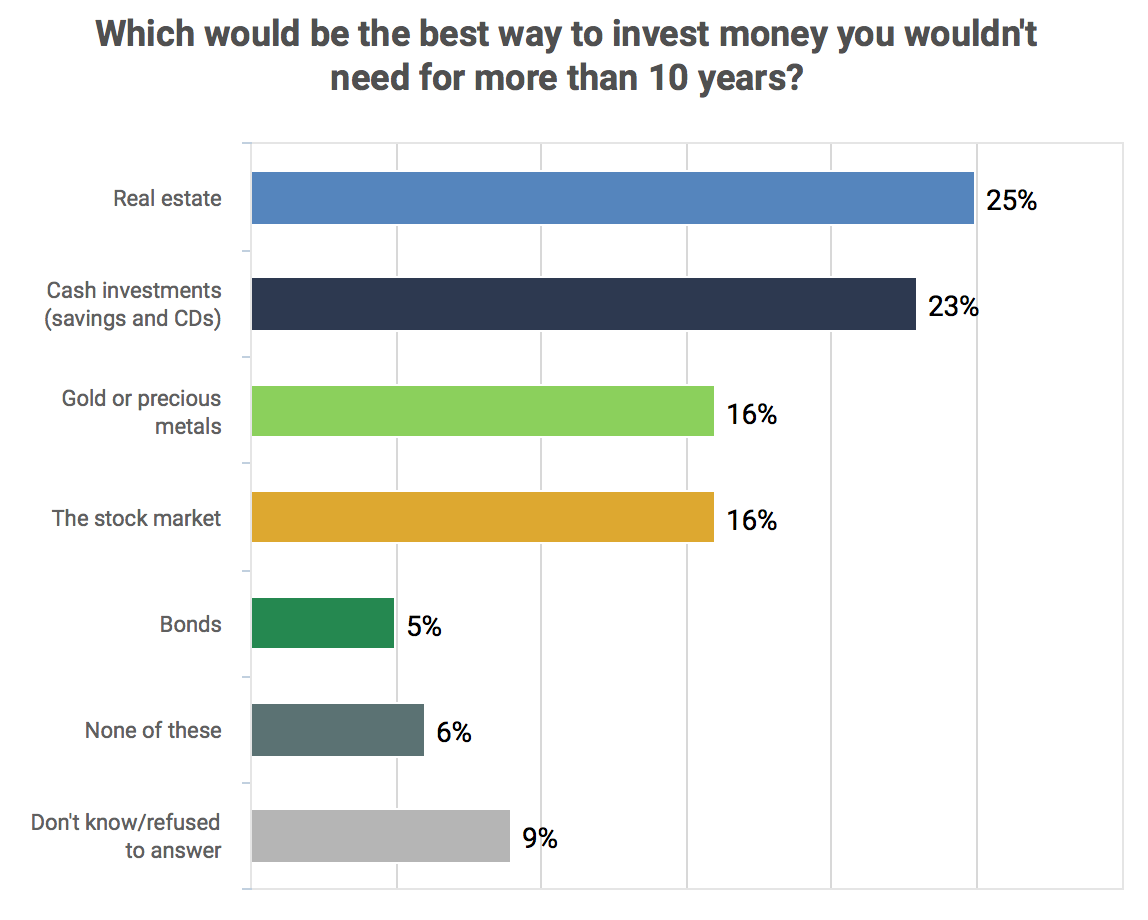

How would you invest money that you know you wouldn’t need for more than 10 years? A recent Bankrate national survey found that real estate was shown to be the most popular long-term investment, next were cash investments such as CDs and savings accounts. Find out more about this survey in this article by Claes Bell of Bankrate.

Source: Bankrate financial Security index survey

Financial security improving

Americans may not be bullish on the future of the stock market, but their present is looking pretty good. For the 26th consecutive month, the Bankrate Financial Security Index — based on survey questions about how people feel about their debt, savings, net worth, job security and overall financial situation — shows Americans’ sense of financial well-being continues to improve.

That’s even though feelings of job security dropped a bit this month, despite a strong June employment report that was released the week our survey was conducted, says Greg McBride, CFA, Bankrate’s chief financial analyst.

While Americans’ sense of job security is still improved from a year ago, the reading was not as glowing as those seen in recent months.

Put your money where your house is

The most popular long-term investing option in our survey was real estate, favored by a quarter of Americans.

That makes sense to Sterling White, co-founder of Holdfolio, a real estate investment firm.

“Houses are tangible. You can physically see and feel the product. So you know where your money is going: It’s going into that house,” White says. “With stocks, you have no clue where your money is going.”

White also sees real estate as a sanctuary from the disruptions and volatility of the stock market.

But Ramnani, of Francis Financial, says it has some clear downsides.

“It is an illiquid asset. It’s not something you can turn around overnight. It takes a while to sell,” she says. “When you need the money, you don’t know what the real estate market is going to do.”

And unlike intangible investments such as stocks and bonds, owners can’t just leave an investment property in an account online somewhere and forget about it.

“There is the cost factor,” Ramnani says. “You have to maintain it.”

[Read the full article here.]