As mortgage rates achieved a new low for the fourth time in the past five weeks, there may never be a better time to buy your new dream home! Kathy Orton reports on this new historic low and what it can mean for new home buyers in this recent article for The Washington Post.

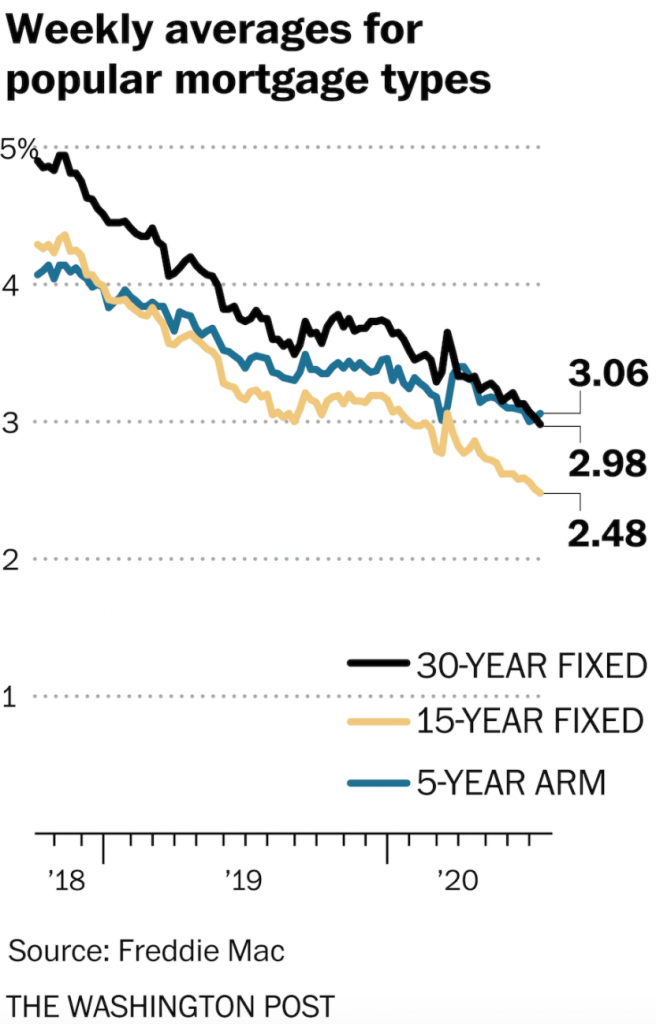

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average tumbled to 2.98 percent with an average 0.7 point. (Points are fees paid to a lender equal to 1 percent of the loan amount and are in addition to the interest rate.) It was 3.03 percent a week ago and 3.81 percent a year ago. Since November 2018, when it was 4.94 percent, it has fallen nearly two percentage points.

The 30-year fixed rate is at its lowest level since Freddie Mac began tracking mortgage rates in 1971. It surpassed the previous low of 3.03 percent, set last week. This is the seventh time the 30-year fixed rate has fallen to a new low in the past several months.

Freddie Mac, the federally chartered mortgage investor, aggregates rates from 125 lenders nationwide to come up with weekly national average mortgage rates. It uses rates for high-quality borrowers who tend to have strong credit scores and large down payments. These rates are not available to every borrower.

The 15-year fixed-rate average slipped to 2.48 percent with an average 0.7 point. It was 2.51 percent a week ago and 3.23 percent a year ago. The five-year adjustable rate average rose to 3.06 percent with an average 0.3 point. It was 3.02 percent a week ago and 3.48 percent a year ago.